Table of Content

You can use this time to find a new home, so you only have to move once. A lease-back will only work if the new owner agrees to it. Ask friends if they’ll let you in for a few months or look for a nearby hotel. When you’re selling in order to buy another home, timing is often important.

Your real estate agent will also help you with a marketing plan for your home and will make suggestions on how to stage your home so that it looks enticing to buyers. A bridge loan, like it sounds, can help bridge the gap between now and when your home is sold. A bridge loan is a type of personal loan that will be repaid whenever you close on your old house. If you can’t sell your current house but still want to move, they might even be able to find you a long-term tenant to cover some of the costs of your first mortgage.

See What You Qualify For

But, you don’t have to wait several months before a buyer comes knocking on your door. Offerpad can provide you with a cash offer for your home in under 24 hours. Some homeowners want a smooth transition from their current home to a new home. You can manage the balancing act of buying and selling at the same time. An iBuyer can quickly present you with a cash offer and speed up the sale. You don’t have to promote your listing or reach out to prospects.

Region next year — which in turn adds to demand in the housing market. Terry Clower, with the Center for Regional Analysis, said he expects rates to stay within the 6% to 6.75% range to finish out the year. In many ways, after the red-hot boom years of 2020 and 2021 for residential real estate, the market seems to be returning to normal. If you withdraw from your retirement account — either a 401 or an IRA — before you hit 59 ½ years old, you’ll have to pay a hefty fee. Typically, the IRS will charge a 10% penalty and require you to pay income taxes on your withdrawal. At HomeLight, our vision is a world where every real estate transaction is simple, certain, and satisfying.

Market: Does it favor buyers or sellers?

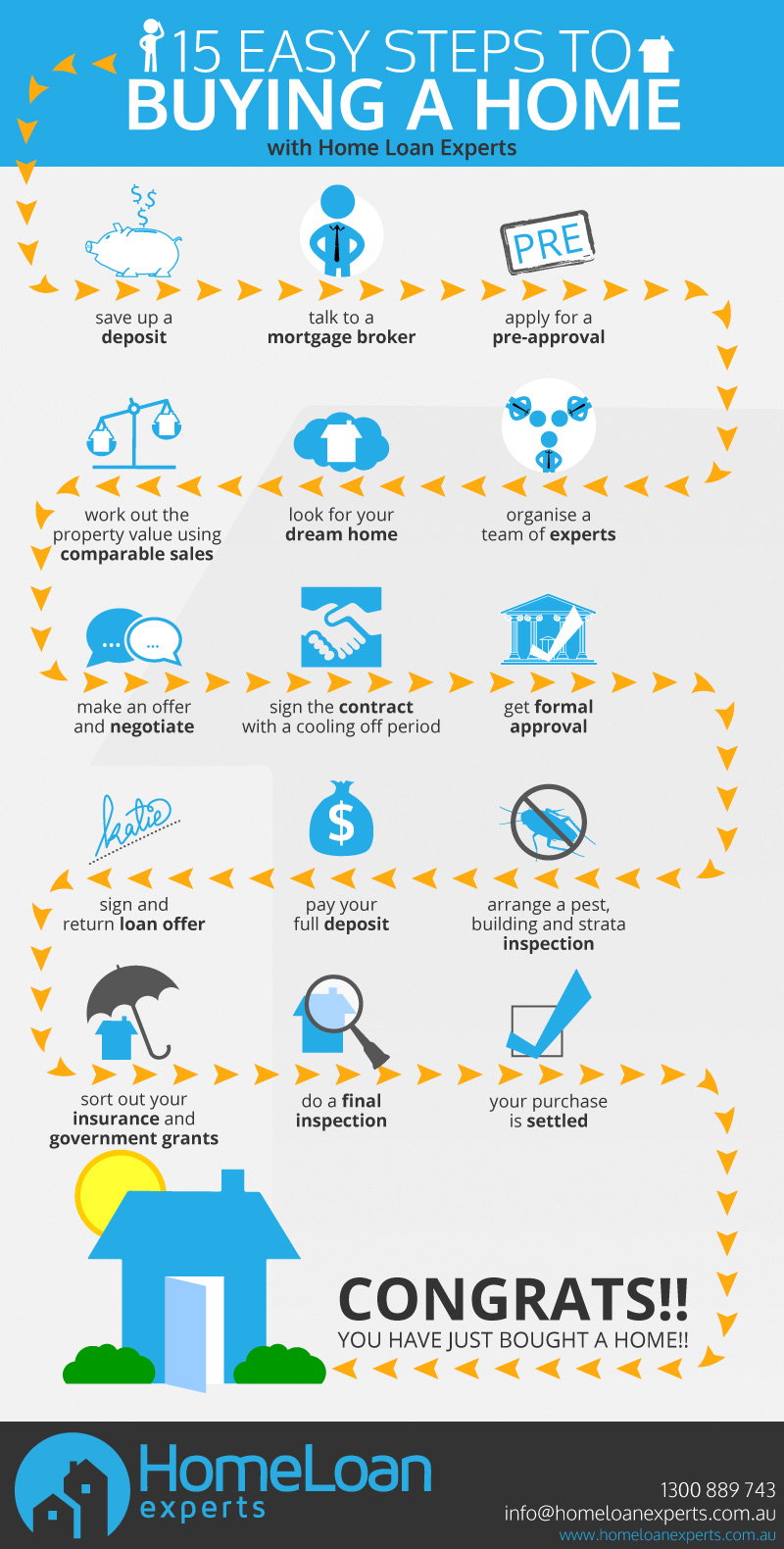

Let’s take a look at a standard timeline for buying and selling your home, assuming there are no issues or hiccups. Consider HomeLight Trade-In to avoid the stress of buying and selling at the same time. These are all questions to answer before you’re actually in this kind of situation, when you may be too stressed to think as clearly. One factor that’s easy to overlook is that iBuyers also eliminate the emotional element of finding a buyer yourself. When buying a home it is imperative to shop around before choosing a lender.

These markets also increase the likelihood of bidding wars. Some homeowners prefer not to time the markets, but paying attention to the current market can increase your proceeds from both transactions. You don’t know how long it will take to find your next home. Selling your current house first helps you avoid two mortgage payments. Some families are in a financial pinch and struggle to afford the current mortgage.

Know your financial solutions

IBuyers tend to be property investors who are happy to buy homes “as-is”. They offer market value, all-cash offers on properties no matter their fittings and fixtures. You do not have to spend thousands of dollars renovating your home.

Sellers who are trying to buy and sell concurrently often submit contingent offers, where they offer to buy a home based on selling their current home first. While this can be successful in some markets, if you’re attempting to buy in a sellers market, a contingent offer is much less desirable. By selling first, you present stronger offers, and you’ll be more likely to get the house you want. Your real estate agent will be your guide during all of this.

Steps for Buying and Selling at the Same Time

No matter how carefully you plan your transactions, surprises can occur. Things might not happen on schedule — or might fall through completely. If you have contingencies in your contract, you should be able to reschedule the closings accordingly or walk away with minimal financial pain. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

When you’re unsure if you want to get rid of an item, ask yourself, “Do I want to move this in a few weeks? You can also set up a yard sale to make some money from those unwanted items. Whether you decide to sell your home first or buy your next house first, the steps to take are the same. But if you follow these steps, you can simplify the home buying process, lower your stress and make it a painless experience. Before we get to the steps, though, here are some important factors to consider.

Keep in mind that many of the options to help solve problem #1 will hurt your efforts in solving problem #2. Work with your financial advisor to review your options and discuss how a particular strategy may impact your overall situation before taking action. Plus, if you have a home to move into, then you won’t have to pay for moving expenses twice.

More recently however, the market has begun showing signs of cooling down, with more housing inventory available and sharply increasing mortgage rates putting a damper on sales activity. However, both transactions rarely happen at the same time. You may sell your current home first and continue negotiating the terms for your dream home.

While this is annoying, a purchase falling through should be an inconvenience rather than a crisis. If you’re attempting to buy a new home before your house is sold, it’s vital that you weigh the odds that a contingent offer will succeed. Consult your real estate agent on the best way to go about this process. You might even qualify for a conventional mortgage loan that requires down payments as low as 3% of your home’s purchase price. Fortunately, there are options you can turn to for financial relief when you’re buying and selling at the same time.

On the flip side, if you sell your home first and cannot find a new house, you may be left stranded. One option, in that case, might be moving into a temporary rental home or bunking up with a relative until you’re able to find a new property, and that may cost you more money down the line. Nordaune says that most people who take out a bridge loan put their house on the market as soon as they find a new home to purchase. “Ultimately, they try to line up the closing dates as close as possible,” she explains, in order to reduce the amount of time their bridge loan is open. Before you begin choosing the best way to buy a house while selling your own, talk to a real estate agent who can explain and break down all of your options. At its earliest steps, the staging process includes going through your possessions, decluttering, and tossing out anything that doesn’t seem worth the trouble to move.

With a sale and settlement contingency, you won’t be required to lock in your new home purchase until your home sale is ready to go. If that happens, you’ll get notification of the new offer and will have the option to remove the contingency and go forward with the purchase or to back out. What will you do if there’s a break in between when you sell a home and buy a new one?

For example, if homes are in high demand, then you will get more interest from potential buyers. This usually means that it is easier to find a buyer who will meet your asking price. Buyers may enter into a bidding war for your property, even if it needs work.

No comments:

Post a Comment